The new calculus of value creation, velocity, and global scale

By Ravi Annadurai

If you notice, over the last three years, the private equity (PE) landscape around SaaS has fundamentally shifted. Valuation multiples have compressed. Investors are demanding profitable growth. Boards are pushing for faster execution with tighter engineering budgets. Actually product companies are under pressure to modernize platforms, embrace AI, and accelerate roadmap delivery all at once.

As a result, PE-backed SaaS firms are increasingly re-evaluating their global engineering models. Gone are the days when outsourcing alone could deliver long-term leverage, and when onshore engineering teams could scale without efficiency constraints. Today, value creation depends on a more strategic foundation captives, GCCs, distributed pod models, modernization engines, and India-based product capability centers.

This shift is not theoretical. It is accelerating and industry analysts agree.

- McKinsey notes that global engineering hubs are “becoming innovation engines, not just delivery units,” especially for software and digital-native companies.

- Deloitte states that modern GCCs are now “strategic business enablers and value creators, not cost centers.”

- NASSCOM reinforces that firms with India-based engineering centers experience “higher innovation velocity and more resilient product delivery models.”

For PE-backed SaaS firms looking for speed, cost efficiency, modernization, and EBITDA lift, this shift is defining the next wave of operational value creation.

1. The New Reality: Outsourcing Alone Can’t Deliver the Playbook

For years, SaaS companies relied heavily on vendor-driven models for capacity scaling. But PE investors and product leaders are now discovering the limitations:

a. Vendor fragmentation → high cost + low ownership

Many SaaS firms operate with 3–6 vendors covering QA, DevOps, SRE, analytics, feature development, L2/L3 support, security, and more.

This drives:

- high coordination overhead

- inconsistent code quality

- fragile knowledge retention

- inflated blended costs

A PE Operating Partner commented:

“We used outsourcing to scale. We use GCCs to take back ownership.”

b. Onshore hiring is expensive and slow

In the US and Europe, competition for senior engineers, cloud specialists, and AI/ML talent drives salaries up significantly . Hiring cycles often exceed 8–12 weeks.

c. AI has changed the game

AI-driven product features, copilots, ML models, data pipelines, and automation require deep technical talent. Vendors can deliver capacity, but not always capability.

This is creating a structural shift from outsourcing → captive global capability building.

2. PE Playbook: Value Creation Requires Structural Engineering Leverage

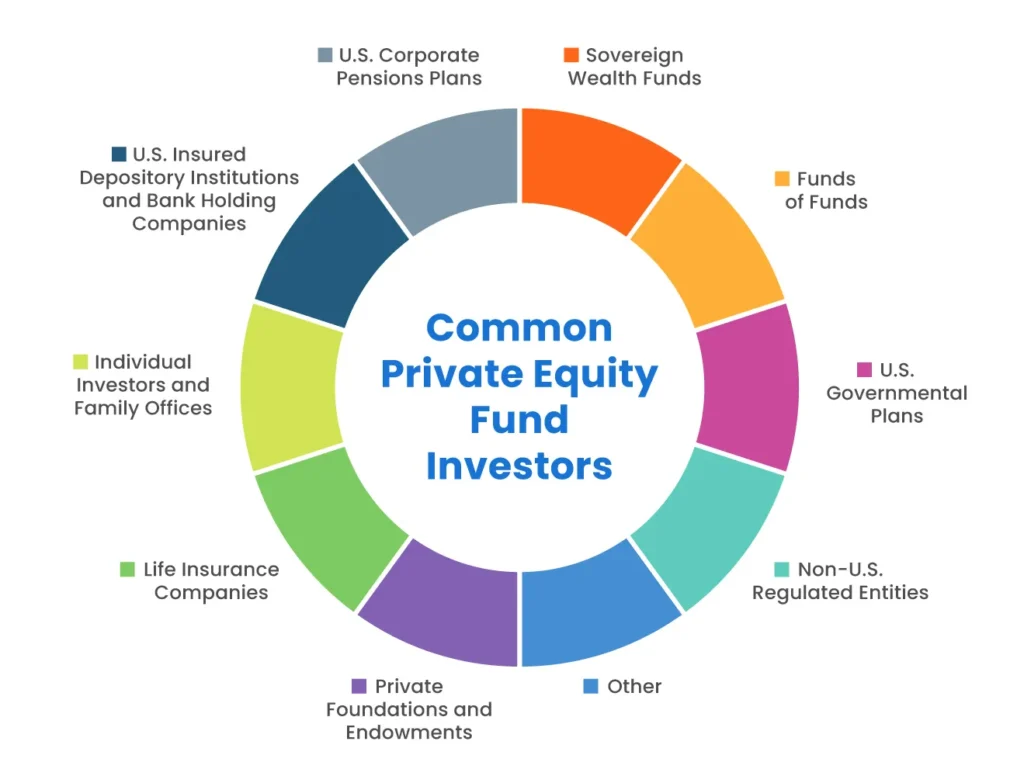

PE firms are re-evaluating engineering models because GCCs unlock the exact metrics LPs and boards prioritize.

a. EBITDA Expansion Through Structural Cost Optimization

Unlike vendor contracts, GCCs create a predictable, stable cost base.

Zinnov research shows that India-based GCCs deliver:

- 30–35% savings on engineering run rate

- significant reduction in vendor overhead

- better scalability without cost shocks

One PE Principal explained:

“Every SaaS deal now includes a build-vs-scale GCC assessment. The economics are impossible to ignore.”

b. Faster Roadmap Delivery and AI Velocity

NASSCOM reports that firms using India-based engineering hubs achieve:

- 25–40% faster feature cycle times

- higher automation coverage

- parallel AI experimentation streams

- fewer release bottlenecks

For SaaS, speed = revenue.

A CTO of a PE-backed customer platform said:

“Our biggest surprise was speed. The India team didn’t just catch up they doubled our release cadence in 90 days.”

c. Platform Modernization Requires Scale

Most mid-market SaaS companies sit on some form of legacy:

- monolithic architectures & aging codebases

- accumulated tech debt & limited observability

- partial cloud migrations & brittle CI/CD pipelines

McKinsey emphasizes that modernization is most successful when organizations “create parallel execution lanes through global engineering hubs.”

For PE investors, modernization is no longer optional, it is a rerating lever.

d. AI Integration Demands Deep Engineering Capacity

AI copilots, semantic search, automation assistants, ML-driven personalization these features now define product competitiveness.

But AI requires:

- data engineering

- ML ops

- experimentation pods

- feature pod integration

- cloud cost optimization

Talent to do this at scale is concentrated in India. Zinnov highlights India as “the global epicenter for applied AI engineering talent.”

3. The Operating Pain Points That Trigger GCC Transitions

Across conversations with PE operating teams and SaaS leaders, four recurring triggers appear:

a. “Our roadmap is slipping again.”

Onshore teams are stretched. Vendors cannot absorb architectural complexity.

A GCC provides stable pods that own modules end-to-end.

b. “We’re spending too much on engineering with too little output.”

Blended vendor costs + senior onshore salaries create bloat.

GCCs create a stable, efficient cost structure.

c. “We cannot find senior engineers fast enough.”

India has the world’s largest concentration of:

- cloud engineers , SREs & AI/ML developers

- full-stack engineers & DevSecOps talent

Scaling becomes predictable.

d. “We cannot modernize and build features simultaneously.”

GCCs solve this by enabling parallel engineering streams.

A head of product at a SaaS spend-management company noted:

“Without our India GCC, modernization would have taken three years. With it, we compressed the timeline to 14 months.”

4. The Strategic Shift: GCCs as Product Engines, Not Cost Centers

Analysts are aligned on one message:

“Modern GCCs drive innovation not just efficiency” — Deloitte Insights

Leading SaaS firms now structure GCCs around product pods, not ticket queues.

Common modules owned by GCC teams:

- core feature development

- AI/ML experimentation & data pipelines

- SRE and reliability engineering & observability

- QA automation & performance testing

- platform modernization & integrations and APIs

- DevSecOps &cloud ops

McKinsey notes that top-performing GCCs “mirror headquarters culture, engineering rigor, and strategic alignment.”

When designed right, GCCs become:

- the source of innovation,

- the center for modernization,

- the engine of release velocity,

- and the home of long-term technical ownership.

5. Why PE-Backed SaaS Companies Are Moving Fastest

a. The PE Clock

With 3–5 year investment horizons, investors need:

- predictable cost structures

- EBITDA uplift

- fast engineering scale-up

- modernization acceleration

- innovation capacity

GCCs deliver all five.

b. The SaaS Competitive Clock

SaaS firms must now:

- ship AI features quickly

- retain customers through continuous value

- maintain secure, reliable platforms

- optimize cloud consumption

- differentiate in crowded markets

No single onshore team can do this alone.

c. The Capital Efficiency Era

With capital tightening, every engineering dollar must yield more output.

GCCs allow firms to double throughput without doubling cost.

A PE portfolio CEO summarized it best:

“The GCC is not our offshore team. It is our second headquarters for engineering.”

Final Word : The New Blueprint for PE-Backed SaaS Engineering

PE-backed SaaS firms are not just rethinking global engineering models, they are rebuilding them.

The new blueprint centers on:

- India-based GCCs for product and engineering

- Distributed pods for velocity

- Parallel modernization

- AI experimentation hubs

- SRE-led reliability uplift

- Predictable engineering economics

Industry Experts reinforce one message: GCCs are no longer cost levers they are strategic value creation engines.

For PE sponsors and SaaS leadership teams facing the dual mandate of speed + efficiency, the question is no longer “Should we build a GCC?”

It is:

“How quickly can we build one and how strategically can we scale it?”

*** END ***