The shift from cost arbitrage to strategic value creation

By Janardan Pendharkar

Over the last decade, global product companies have quietly undergone a fundamental transformation in how they build, scale, and sustain engineering capability. Beyond outsourcing and vendor-driven models, organizations are now embracing Global Capability Centers (GCCs) in India as a core component of their engineering and innovation strategy.

What we once knew as a “cost-effective offshore model” has matured into a strategic, innovation-led, talent-first engine.

India’s GCC ecosystem now home to over 1,750+ centers, according to NASSCOM has rapidly evolved into one of the world’s most sophisticated global engineering networks.

As Deloitte notes, modern GCCs have shifted “from cost centers to strategic business enablers and long-term value creators.”

McKinsey reinforces this, highlighting that leading GCCs today serve as “innovation hubs, not just execution centers.”

So why exactly are product companies especially SaaS, fintech, healthtech, logistics-tech and PE-backed digital firms moving to India?

The answer is a blend of financial logic, product velocity, strategic resilience, and access to the world’s deepest technical talent pools.

1. The Financial Advantage: Structural, Sustainable, and Transformative

a. 20–35% Structural Engineering Cost Optimization

Modern GCCs don’t sell cost arbitrage they deliver structural efficiency.

A US-based mid-market SaaS CEO described it best:

“We stopped thinking about India as a way to cut cost.

We started thinking about it as a way to expand product capacity sustainably.”

By centralizing engineering, QA automation, DevOps, SRE, analytics, and AI development in India, product companies reduce:

- high onshore hiring costs

- vendor/contractor dependency

- overheads associated with scattered teams

- operational inefficiencies and handoff losses

Deloitte research confirms this, highlighting that GCCs enable “predictable and optimized cost models aligned to long-term growth.”

b. EBITDA Uplift Through Vendor Consolidation

Private equity firms find this particularly attractive.

Many product companies run with 3–6 different IT/engineering vendors. This:

- increases cost variability

- dilutes code/IP ownership

- slows knowledge retention

- inflates long-term spend

GCCs allow consolidation into a single, captive engine.

A PE Operating Partner shared an often-repeated sentiment:

“Vendor-driven delivery improves velocity.

GCC-driven delivery improves velocity and value.”

This consolidation has measurable P&L impact:

- 10–15% Opex savings from vendor rationalization

- Higher engineering throughput due to aligned teams

- Better retention and IP continuity

c. Scalable Headcount Without Onshore Inflation

Product companies often struggle with the onshore hiring market salaries are high, talent is limited, and hiring cycles are slow.

India changes that.

Zinnov’s GCC research highlights that India has the largest pool of digital and deep-tech talent globally, with rapid growth in AI, cloud-native development, cybersecurity, platform engineering and SRE.

One CTO of a European product company shared:

“In the US we struggled for six months to hire a senior backend engineer.

In India, our GCC hired 45 engineers in eight weeks.”

Scalability becomes a financial advantage and a product advantage.

2. The Non-Financial Advantage: Innovation, Speed, Culture & Product Depth

a. India Is Now a Product & AI Engineering Powerhouse

Gone are the days when India was seen primarily as an IT services location.

McKinsey calls Indian GCCs “critical drivers of enterprise-wide transformation and innovation.”

Modern GCCs are delivering:

- Product analytics

- User experience and design

- Microservices & cloud-native transformation

- AI/ML engineering & Platform modernization

- Observability, SRE & Performance engineering

- Secure DevSecOps and infra automation

A CPO of a Silicon Valley SaaS firm said:

“Our India team doesn’t just build features; they shape how we build products.”

b. 30–40% Faster Product and AI Iteration Cycles

NASSCOM reports that companies with distributed GCC-based R&D functions see faster innovation cycles, especially in AI, automation, and digital product development.

Firms benefit from:

- full-stack teams working in parallel

- rapid prototyping culture

- strong QA and automation practices

- follow-the-sun engineering workflow

- stable, long-tenured teams who know the product deeply

This directly translates to shorter release cycles and more experimentation velocity.

A PE-backed CTO noted:

“Our AI roadmap was moving too slowly because our onshore teams were stretched.

The India GCC changed the trajectory within one quarter.”

c. Institutional Knowledge, IP Ownership & Long-Term Stability

Vendor teams rotate, but GCC teams stay. That means:

- domain knowledge stays inside

- code integrity is maintained & architectural consistency improves

- product quality compounds over time

Zinnov’s research shows that 45%+ of new GCCs are R&D and product-led, not back-office or support-led indicating a clear shift to long-term ownership.

d. Cultural Alignment & Governance Maturity

Today’s GCCs mirror headquarters through:

- India-based product managers and engineering leaders

- shared architecture councils

- global DevSecOps standards

- unified OKRs & HQ-replicated SDLC

This ensures consistency in:

- product thinking, engineering quality & agile maturity

- security & compliance

As a Fortune 500 CIO told Zinnov:

“We no longer treat India as offshore.

India is now our second headquarters for engineering.”

3. Strategic Advantage: The GCC as the Product Engine of the Future

a. The Pod Model: Distributed, Autonomous, High-Velocity Teams

Product companies thrive when backend, frontend, AI, QA, and SRE teams operate as cross-functional pods.

India makes pod-based scaling viable due to its talent depth.

b. Modernization & Technical Debt Reduction in Parallel

With a GCC, companies can run two streams simultaneously:

- new feature development

- modernization / technical debt cleanup

Many executives admit modernization is nearly impossible without India-scale teams.

c. Reliability Engineering & 24×7 Product Operations

India’s SRE, cloud, and observability communities are among the strongest globally.

This provides:

- faster MTTR

- near-instant incident response

- production stability

- continuous CI/CD improvement

Strong reliability becomes a market differentiator.

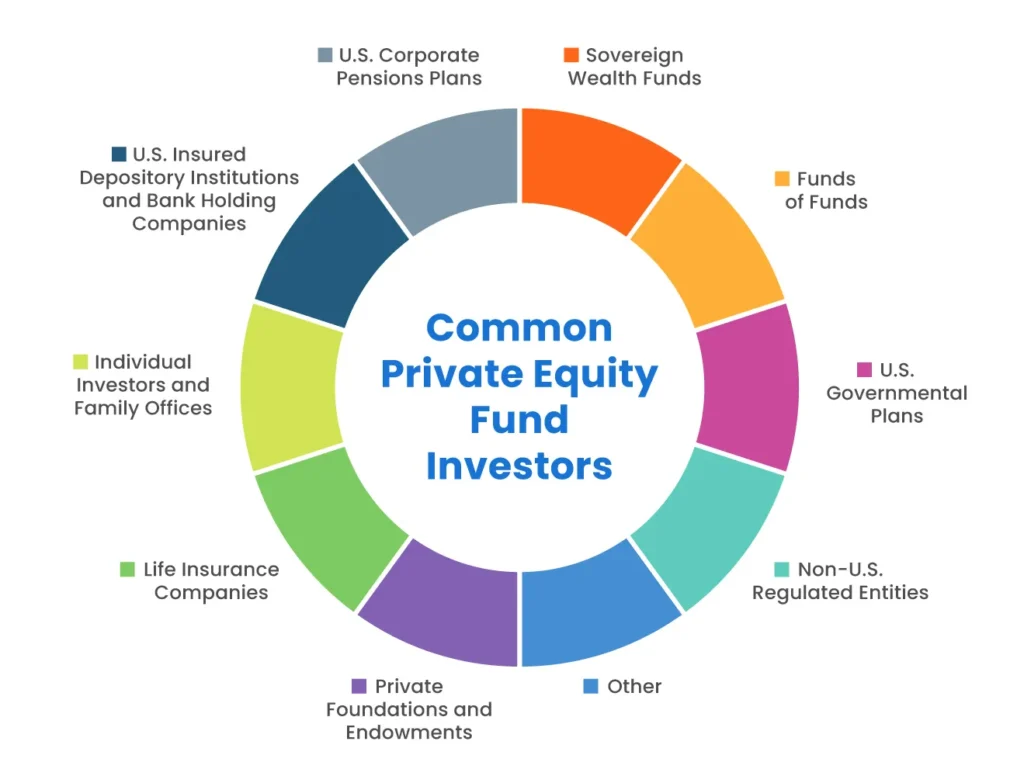

4. PE-Backed Companies Are Moving Fastest Here’s Why

PE firms look for:

- margin expansion

- predictable cost structure

- scalable engineering

- accelerated product delivery

- platform transformation

GCCs deliver all five.

One Operating Partner summarized it clearly:

“If you want to cut cost, outsource. If you want to build value, build a GCC.”

This is why PE-funded SaaS, fintech, healthcare, logistics-tech, and insurtech firms are among the fastest adopters today.

Conclusion: India GCCs Are No Longer Optional , They Are Strategic

With the world’s largest concentration of cloud, AI, product engineering, SRE and full-stack talent, India has become the epicenter of global product development.

Popular Analysts uniformly emphasize the same shift: GCCs are now innovation engines, not execution centers.

For product companies facing pressure to innovate faster, operate leaner, and build resilient, scalable engineering organizations , India is emerging as the most compelling destination to build their next-generation capability center.

What began as a cost lever has now become a strategic differentiator.

**END**