By Ravi Annadurai

Why global product companies and especially PE-backed SaaS firms are redesigning engineering models to capture structural value?

For years, GCCs (Global Capability Centers) were viewed primarily as cost-optimization levers. But in the last decade and dramatically in the last three years they have become a core pillar of value creation for software product companies, particularly those under private equity ownership.

As SaaS valuations compress and profitability becomes non-negotiable, transforming engineering economics has become a board-level agenda. Investors want faster product velocity and lower burn, CFOs demand predictable cost curves, and CEOs seek modernization and innovation without doubling spend.

In this environment, GCCs offer something rare: Structural EBITDA lift.

Not temporary cost cuts. Not vendor arbitrage. Not one-time efficiencies.

But fundamental improvements in unit economics over a 36-month horizon.

Industry analysts reinforce this shift:

- BCG notes that modern GCCs deliver “multi-year value creation through structural improvements, not tactical savings.”

- McKinsey highlights that well-run GCCs generate “compounded productivity gains as capabilities mature.”

- EY states that GCCs “enhance enterprise-level margin expansion through capability consolidation and governance.”

The message is clear:

GCCs are no longer about saving money they are about increasing enterprise value.

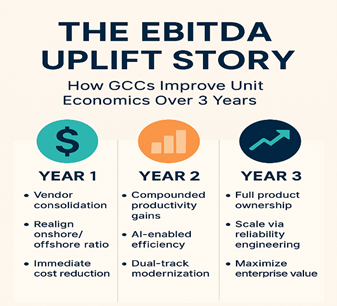

Below, we break down how GCCs improve EBITDA across a typical 3-year value-creation cycle.

Year 1: Structural Cost Realignment & Productivity Stabilization

1. Vendor Consolidation: The First Major EBITDA Win

Most product companies especially those scaling rapidly accumulate a web of outsourcing vendors.

Multiple vendors create:

- overlapping costs & rising blended rates

- duplicated roles & inconsistent code ownership

- quality inconsistency

A PE Operating Partner commented:

“We didn’t realize how much value leakage we had until we built our GCC. Vendor spend dropped 20% without losing capacity.”

By folding fragmented vendor work into a GCC model, companies typically unlock:

- 10–18% immediate OPEX savings

- reduced dependency risk, higher knowledge retention & better governance discipline

Deloitte reports that GCC-driven vendor rationalization “reclaims 10–20% of unmanaged spend within the first 12 months.”

2. Rebalancing Onshore/Offshore Talent Mix

Many SaaS firms have high-cost onshore-heavy teams by necessity, not design.

GCCs enable a healthier mix:

- Senior architects, PMs, and security leaders onshore

- Large engineering pods, QA automation, SRE, DevOps, and AI pods in India

This rebalancing without compromising quality reduces the blended cost per engineer by 30–35%.

A CFO of a PE-backed SaaS company shared:

“We saw immediate annualized savings without touching senior US leadership roles. The cost curve stabilized for the first time.”

3. Early Automation → Early Quality Gains

Top GCCs embed QA automation, DevOps, and observability from day one.

NASSCOM notes that companies with India-based QA automation hubs see:

- 25–40% fewer production defects

- 20–30% faster releases

This reduces the cost of rework a hidden EBITDA killer.

Year 2: Productivity Compounding, Modernization, and AI-Led Efficiency

4. Eliminating Tech Debt Through Parallel Modernization Streams

Most mid-market SaaS companies sit on technical debt:

- Monoliths, legacy code & outdated APIs

- aging CI/CD pipelines & limited observability

In a GCC model, firms can run two parallel tracks:

Track A — Product roadmap

Track B — Platform modernization

This dual-track model is impossible when onshore teams are overloaded.

McKinsey notes that distributed engineering hubs “enable modernization at 2× the pace of traditional teams.”

Over time, modernization yields:

- lower cloud costs

- faster feature development

- reduced cycle time & improved uptime

- fewer customer escalations

Each of these contributes directly to EBITDA.

5. AI/ML Engineering Pods Accelerate Throughput

AI productivity is real, but requires engineering muscle.

GCCs become the hub for:

- AI feature experimentation & ML Ops

- predictive modelling, copilots and automation assistants

- data engineering pipelines

A CTO in a PE-backed healthtech platform said:

“Our India GCC became our AI factory. We ran four experiments a week instead of one a month.”

AI-driven automation alone can improve engineering throughput by 15–25% over 12–18 months.

6. Reduced Attrition = Higher Productivity

Vendor teams rotate. Contractors churn.GCC employees stay.

Zinnov’s GCC reports highlight significantly lower attrition in mature GCCs versus IT services teams.

Lower attrition drives:

- higher product knowledge, stronger architectural continuity, reduced onboarding cost & better quality & faster delivery

Sustained knowledge retention compounds productivity gains another EBITDA lever.

Year 3: Maturity, Scale Economics & Enterprise Value Creation

By Year 3, GCCs shift from efficiency → strategic value creation.

7. Ownership of Critical Product Modules

As GCC maturity grows, teams take on:

- full module ownership

- platform reliability

- modernization roadmaps

- analytics and data engineering

- SRE and observability

This deepens accountability and dramatically reduces cycle time.

BCG calls this “capability-based scaling” the most valuable phase of GCC ROI.

8. Reliability Engineering → Lower Incident Costs & Higher NRR

SRE-driven GCCs improve:

- MTTR, uptime & SLA compliance

- root-cause discipline & customer issue resolution

In SaaS businesses, every incident has a cost and each reliability improvement protects renewal revenue.

A COO at a global SaaS platform shared:

“Once our India GCC owned SRE, customer escalations dropped 35%. Our NRR improved without extra spend.”

Improved reliability = improved retention = improved LTV/CAC → EBITDA uplift.

9. Predictable Cost Curves → Better Capital Allocation

EY notes that GCCs create “long-term cost predictability, enabling disciplined capital deployment.”

For PE-backed companies, this is crucial:

- stable engineering costs, fewer vendor surprises, predictable hiring cycles & less dependency on inflated onshore markets

Predictability strengthens EBITDA and increases exit valuations.

10. The 3-Year Compounding Effect

By Year 3, GCC contributions typically include:

- 20–40% reduction in engineering run-rate

- 25–50% improvement in release cadence

- 15–25% AI-enabled productivity uplift

- 30–40% fewer production incidents

- stronger NRR due to platform stability

- parallel modernization enabling faster GTM

- long-term IP ownership reducing leakage

These are not theoretical gains they are observed across dozens of global GCC case studies.

A PE Operating Partner summarized it best:

“The GCC was not our cost lever. It was our value creation engine over three years.”

Final Word : The GCC Is the Most Reliable 3-Year EBITDA Engine

GCCs transform engineering economics in a way outsourcing never can. The 3-year uplift is structural, not cyclical.

Year 1 → Cost restructuring & stabilization

Year 2 → Productivity lift & modernization

Year 3 → Full ownership, scale efficiency & enterprise value creation

For PE-backed SaaS firms navigating valuation pressure, modernization needs, and the AI wave, the question isn’t whether to build a GCC.

It’s whether they can afford not to.

*** END ***