The new value-creation engine for SaaS and digital portfolio companies

By Ravi Annadurai

In 2025, Global capability centers (GCCs) have moved from a “nice-to-have lever” to a central pillar of the value-creation playbook for private equity (PE) firms. As SaaS multiples compress, as product companies balance growth with profitability, and as AI accelerates the need for engineering capacity, PE Operating Partners are asking a consistent set of questions:

- How do we scale engineering without inflating burn?

- How do we modernize aging platforms while still shipping features?

- How do we execute AI roadmaps with limited onshore talent?

- How do we improve gross margin and EBITDA in the next 3–5 years?

Increasingly, the answer is the same: Build or scale a GCC in India.

This is not a theoretical shift it is grounded in data, economics, and successful transformations across SaaS, fintech, healthtech, logistics-tech, and industrial tech portfolios.

Industry analysts reinforce this momentum:

- Deloitte states GCCs have become “strategic value creators, not cost centers, delivering capability, speed, and structural efficiency.”

- McKinsey describes modern GCCs as “innovation hubs powering enterprise transformation.”

- EY notes GCCs “improve EBITDA through structural cost optimization and capability consolidation.”

- NASSCOM reports GCCs are now responsible for “higher innovation velocity, higher automation, and lower cost of product delivery.”

For PE Operating Partners, this shift represents one thing: a proven, repeatable, and compounding value-creation engine.

Below are the 2025 insights PE leaders need to know.

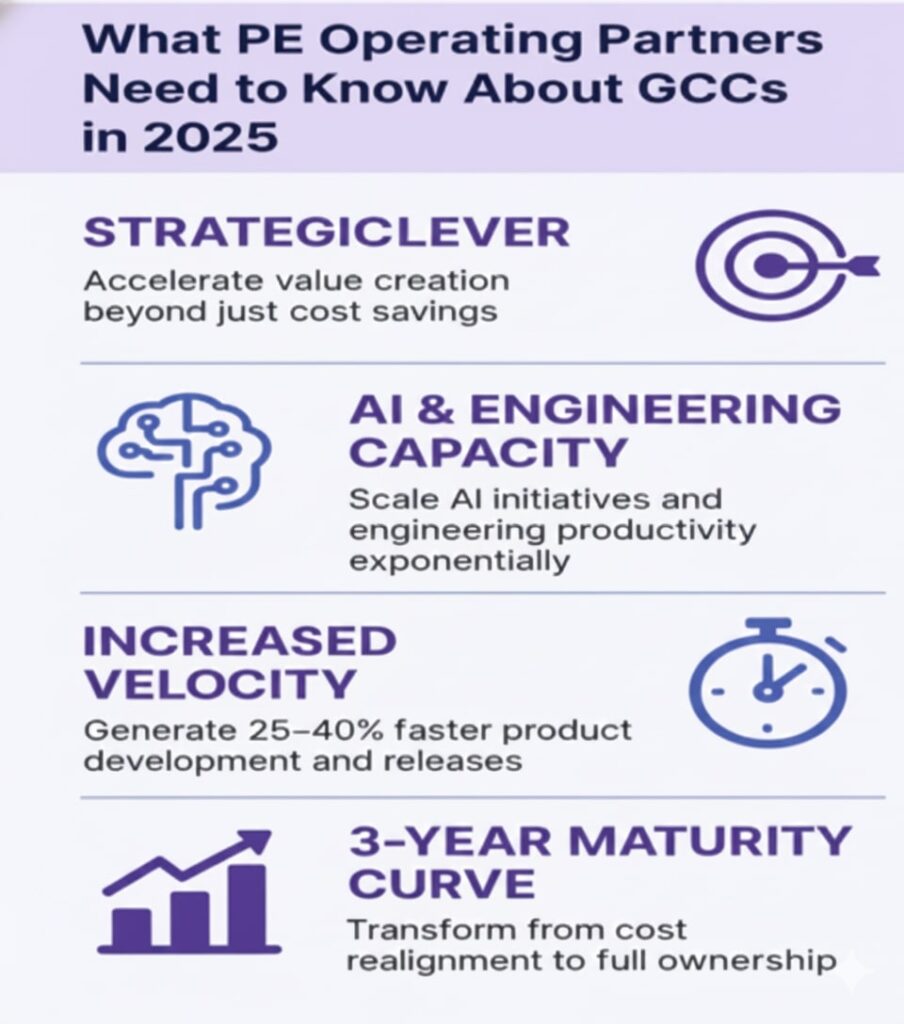

1. GCCs Are Now a Strategic Lever, Not an Offshore Cost Play

In 2025, the old narrative GCCs as “low-cost offshore centers” no longer applies. Modern GCCs:

- build entire product modules & lead AI experimentation

- run SRE, observability, and reliability engineering

- handle data engineering and ML Ops

- support modernization and platform transformation

- own CI/CD, QA automation, and DevSecOps

- create parallel lanes for modernization and roadmap delivery

A PE Operating Partner at a global fund shared:

“Earlier, we used GCCs to reduce cost. In 2025, we use them to accelerate value creation.”

The shift is profound: GCCs now deliver capability, not just capacity.

2. The Economics Are Too Compelling for PE Firms to Ignore

Across 2023–2025, engineering cost inflation hit historic levels across the US and Europe. Many SaaS firms are carrying:

- high onshore salary burdens & vendor-heavy execution models

- low automation maturity & stretched engineering teams

- delayed modernization & AI initiatives with no bandwidth

A GCC addresses these structurally.

Zinnov estimates GCC-driven engineering run-rate optimization at 30–35% once stabilized.

EY highlights predictable cost curves as a major value driver during PE hold periods.

A CFO of a PE-backed SaaS firm said:

“Our GCC created cost visibility for the first time. We could finally plan EBITDA expansion instead of hoping for it.”

3. AI Has Changed Everything GCCs Are the Only Scalable AI Engine

In 2025, every SaaS and digital firm is working on AI features:

- copilots, semantic search, predictive scoring, automated workflows, generative enhancements & ML-driven personalization

The problem? à Onshore AI talent is expensive and scarce. Vendor-based AI work is slow and not IP-secure.

GCCs become the AI experimentation factory, offering pods that can run:

- 5–10 ML or AI prototypes in parallel

- rapid iteration cycles

- scalable data engineering pipelines

- end-to-end ML Ops

- cost-efficient fine-tuning of models

A CTO of a PE portfolio company remarked:

“Our AI roadmap went from ‘ambitious’ to ‘achievable’ once our India GCC took over.”

AI work demands scale. GCCs provide it.

4. GCCs Enable the “Dual-Track” Product Strategy PE Firms Care About

PE-owned companies often face a structural conflict:

Track A — Build new features to grow revenue

Track B — Modernize the platform to reduce cost & risk

Most engineering teams cannot sustain both tracks simultaneously.

This is where GCCs change the game.

McKinsey notes that high-performing global engineering hubs accelerate modernization “by enabling parallel lanes of execution without slowing core roadmap delivery.”

A Head of Engineering from a portfolio firm shared:

“The GCC handled modernization. Our US team focused on the roadmap. For the first time, both tracks moved forward.”

For Operating Partners under pressure to show platform readiness at exit, this is a major differentiator.

5. GCCs Improve Reliability, Which Improves NRR and Valuation

In SaaS, reliability is not a technical metric it is a financial one.

Poor uptime affects:

- NRR, customer churn, support costs, SLA penalties, onboarding friction & reputation

GCCs are now the global center for:

- SRE, observability, incident response, automation & resilience engineering

BCG emphasizes that mature GCCs improve “service reliability and customer experience, leading directly to higher retention.”

A COO at a PE-backed SaaS platform noted:

“Once our GCC took over SRE, customer escalations dropped 35%. It was the hidden EBITDA win.”

6. GCCs Increase Engineering Velocity by 25–40%

NASSCOM reports that companies with GCC-led DevOps and automation see:

- 20–30% faster release cycles

- 25–40% more experiments

- fewer bottlenecks in development

- higher test automation maturity

A CEO of a PE-backed customer experience SaaS firm noted:

“Velocity became our competitive advantage. The GCC unlocked it.”

For Operating Partners, increased velocity often means:

- faster GTM, faster AI rollout, faster product differentiation & better valuation narrative

Velocity is value creation.

7. GCC Maturity Compounds Over a 3-Year Hold Period

The GCC value-creation curve aligns perfectly with a PE lifecycle:

Year 1 — Cost Realignment & Vendor Consolidation

- 10–20% OPEX reduction

- immediate vendor rationalization

- stabilized engineering costs

Year 2 — Productivity, Modernization & AI Acceleration

- modernization velocity increases

- AI pods become operational

- tech debt is reduced

- automation improves quality

Year 3 — Ownership, Excellence & Enterprise Value Creation

- GCC owns entire product modules

- reliability improves; NRR increases

- EBITDA uplift becomes structural

- valuation multiple expands

EY notes that the full value of GCCs emerges “in years 2 and 3, with compounding effect on enterprise value.”

A PE Operating Partner reflected:

“Our best exits in the last two years all had one thing in common a high-performing India GCC.”

8. GCCs Create the Talent Flywheel PE Firms Need

India provides:

- the world’s deepest product engineering pool

- unmatched AI/ML talent density

- strong DevOps, SRE, QA automation communities

- cloud-native engineering expertise

- leadership talent ready to run global teams

Zinnov’s research emphasizes India’s “unmatched scaling ability for product organizations.”

For Operating Partners, this means:

- faster hiring, stable teams, lower attrition & deeper institutional knowledge

Predictability of talent = predictability of value creation.

Conclusion: GCCs Are Now the Most Reliable PE Value-Creation Lever

In 2025, the operating environment demands more from engineering organizations:

- Faster AI adoption – Modernized platforms – Lower burn – Higher reliability – Better customer retention – Faster execution – Scalable talent

GCCs solve all of these, structurally and sustainably. The emerging PE consensus is clear:

GCCs are no longer optional. They are the operating model of the future.

For PE Operating Partners tasked with driving EBITDA expansion, accelerating AI transformation, and positioning companies for exit, the GCC is not just a lever. It is the strategy.

*** END ***